Motoring Market

Halfords Group addresses two distinct areas of the UK's highly-fragmented motoring market - car parts, accessories, consumables and technology; and car servicing and aftercare. From the perspective of the former, there is no single equivalent competitor. In respect of the latter, there are over 30,000 garages in the UK, an estimated two-thirds of which are small independents.

Car Parts, Accessories, Consumables and Technology

Key Facts

2+%

Forecasted Market Growth

Market Trends

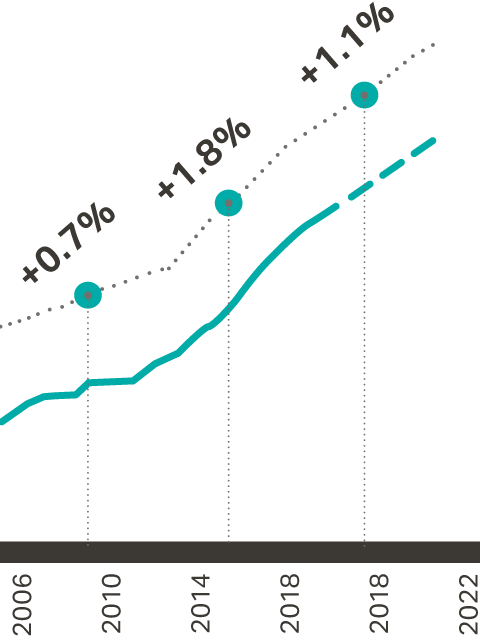

The UK car parc has exhibited steady growth...

UK Car Parc

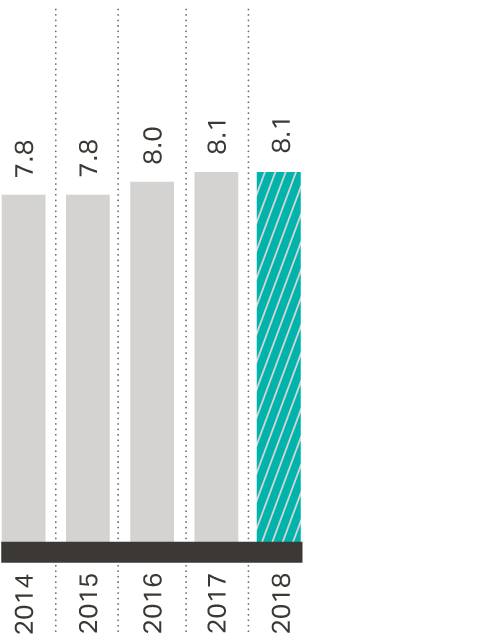

...with the average age of cars gradually rising

Average Age of UK Cars

Our response

Car parts, accessories, consumables and technology

Our strong heritage and brand means Halfords is a destination for consumers who want assistance with their cars. We continue to make progress in our markets through investment in our stores and colleagues to help deliver innovative products and services to our customers when and where they want them.

Car Servicing

and Aftercare

Key Facts

2+%

Forecasted Market Growth

Market Trends

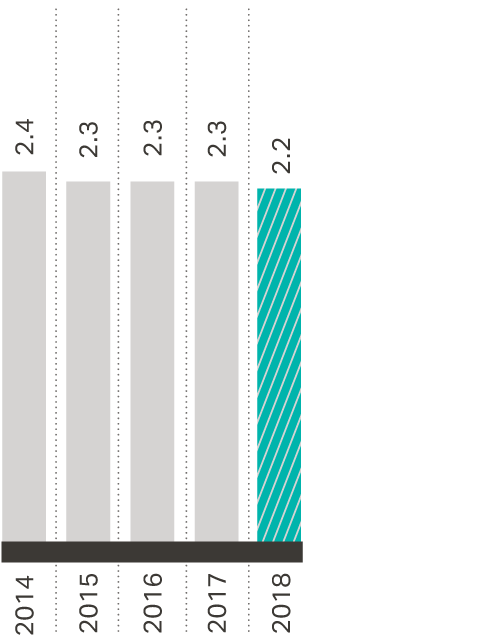

Cars are becoming more reliable...

Visit to Garage Per Year Light Vehicle – Frequency

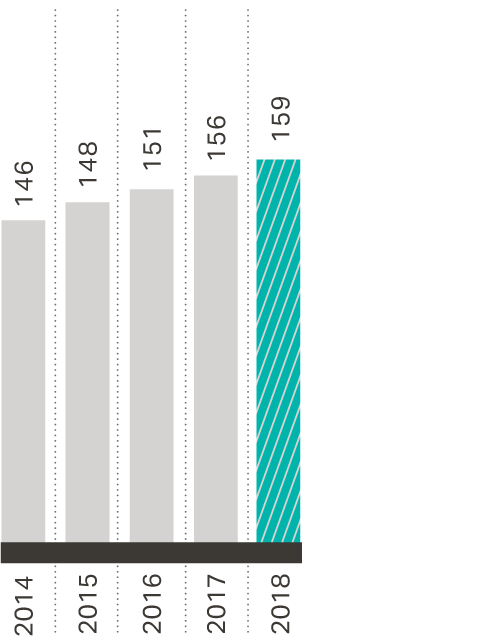

...but more expensive to fix

Average Visit Spend – £

Our response

Car servicing and aftercare

We will continue to invest in equipment and colleague training in order to remain at the forefront of technological changes. This will give us a competitive advantage in a fragmented market of independent operators.

Specifically, we have made significant progress in providing industry-accredited training to Autocentres colleagues in the servicing and maintenance of hybrid and electric vehicles.

Motoring Market – Competitor Landscape

Car products and related fitting

- Limited number of specialists but a highly diverse and competitive set of retailers

- Limited retail bricks and mortar competition

- Wholesalers and generalists moving into specialist retail markets with strong omnichannel offer

- Supermarkets and garage forecourts continue to sell a limited range of high-volume, high-margin products

- Independent garages offering car parts and associated fitting

How is Halfords Group different

Our 125-year heritage has established Halfords as a household name, with over 90% of the UK population living within 20 minutes of a Halfords store. We have many outstanding strengths that differentiate us, notably our diverse product range and our colleague expertise. Significantly, we have an established and growing ability to provide services on demand in-store.

Car Servicing

- Technological advancements limit scope for effective delivery by independents

- Car dealerships expanding into used car servicing

- Some evidence of sales aggregation (e.g. My Car Needs A…) and mobile services entrants (e.g. Tyres On The Drive)

How is Halfords Group different

Via our Autocentres, Halfords Group offers great value and convenience for UK consumers of car servicing, repairs and MOT compliance. The strength of our brand and the scale of our store and garage estate enables us to invest in the most up-to-date equipment and technology. We have recently begun trialling Halfords Mobile Expert which delivers elements of car servicing, such as battery replacement, tyres and diagnostic checks, direct to the customer at their home or workplace.

Long-term market trends

As UK motorists become more engaged with issues affecting their impact on the environment, they are seeking ways of mitigating against them. At the same time, the Government has increased taxation of diesel cars. As a result, 2018 saw a c.30% reduction in diesel car registrations and an increase in petrol registrations of 9%. Significantly, hybrid and electric registrations were up 21%. Although relatively low volume in comparison, this trend continues to gain momentum.

Cars are becoming more complex. Alongside advances in engine technology, cars are being equipped with an increasing number of intelligent features in order to meet the rising expectation of consumers. Obvious examples include mobile telephone technology enabling the legal and safe making of calls on the move, and advanced satellite navigation capability. The long-term expectation will be that all devices will offer an integrated 'always-on' flow of information.

Autonomous cars, whilst a futuristic concept, are the focus of significant investment by global innovators such as Google and Tesla. Many new cars are now partially-autonomous, providing lane change assistance, parking assistance and adaptive cruise control. There is a high probability that children born today may never need to drive a car.

All of these disruptive changes mean that it is becoming less likely that car owners will possess the knowledge or equipment to replace worn parts or service their own cars in the future. The increasing demand for a 'do it for me' proposition will continue to rise.