Board Composition

As at the date of this report, the Board of Directors comprised six members, namely the Non-Executive Chairman, three other Non-Executive Directors and two Executive Directors. The composition of the Board is set out in the Directors' Report and the biographies of each Director, including any other business commitments, are available in the Board of Directors. The Board believes that it has an appropriate balance of Executive and independent Non-Executive Directors having regard to the size and nature of the business. The Board also believes it has an appropriate balance of skills and experience, Further details are available in the Corporate Governance Report.

Chairman1

Executive Directors2

Non-Executive Directors3

Board changes

On 24 July 2018, Keith Williams joined Halfords as Chairman. Keith succeeded Dennis Millard who stepped down from the Board following a tenure of nine years.

On 1 November 2018, Halfords welcomed Loraine Woodhouse to the business following the resignation of Jonny Mason. Jonny tendered his resignation as Chief Financial Officer on 27 March 2018 to take up the position of Group Finance Director for Dixons Carphone plc. Jonny left Halfords on 31 July 2018, and in the period between him leaving the Company and Loraine Woodhouse joining, Katrina Jamieson, Business Transformation Director, acted as Interim Chief Financial Officer.

On 27 February 2019, Halfords announced the appointment of Jill Caseberry as Non-Executive Director and Chair of the Remuneration Committee with effect from 1 March 2019. Jill succeeded Claudia Arney who stepped down from the Board on1 March 2019.

Board Independence

The Non-Executive Directors bring wide and varied experience to the Board and its Committees. The Company recognises the importance of its Non-Executive Directors remaining independent. This is in accordance with the Code which recommends that, at least half of the Board of Directors, excluding the Chairman should comprise Non-Executive Directors, who are determined by the Board to be independent in character and judgement and who are free from relationships or circumstances which may affect or could appear to affect the Non-Executive Director's judgement. Following a rigorous review, the Board considers David Adams, Helen Jones and Jill Caseberry to be independent in character and judgement and, therefore, that Halfords is compliant with the Code, with at least half of the Board, excluding the Chairman, deemed to be independent. The Chairman, Keith Williams was considered independent upon his appointment.

Re-election

In compliance with the Code and the Company's Articles of Association, the majority of the Directors on the Board as at 21 May 2019, will seek re-election at the 2019 Annual General Meeting ("AGM"), these being, Keith Williams, David Adams, Helen Jones and Graham Stapleton. Jill Caseberry and Loraine Woodhouse will be elected for the first time at the 2019 AGM.

Board Responsibilities

The Board is responsible for the long-term success of the Company and is committed to ensuring that it provides leadership to the business as a whole, having regard to the interests and views of its shareholders and other stakeholders. It is also responsible for setting the Group's strategy, values and standards. Details of the Group's business model and strategy can be found in Our Business Model.

Division of Responsibilities

The roles of Chairman and Chief Executive Officer are separate and clearly defined, with the division of responsibilities set out in writing and agreed by the Board.

The Chairman is responsible for effective leadership, operation and governance of the Board and its Committees. He ensures effective communication with shareholders, facilitates the contribution of the Non-Executive Directors and ensures constructive relations between Executive and Non-Executive Directors.

The Chief Executive Officer is responsible for the management of the Group's business and for implementing the Group's strategy.

The Directors, together, act in the best interests of the Company via the Board and its Committees, devoting sufficient time and consideration as necessary to fulfil their duties. Each Director brings different skills, experience and knowledge to the Company, with the Non-Executive Directors additionally bringing independent thought and judgement. This combination seeks to ensure that no individual or group unduly restricts or controls decision-making.

Director Tenure and Board Succession

Succession planning for the Board continues to be ongoing and is considered in detail during the annual evaluation of the Board performance. Given the appointment of the new Chairman, the Chief Financial Officer and the new Chair of the Remuneration Committee, it has been determined that the Chairman will review the composition, skills and experience of the Board and agree the priorities for the coming year.

A formal schedule of matters reserved for the Board is in place and regularly reviewed.

To discharge these responsibilities effectively, the Board has a system of delegated authorities. This enables the effective day-to-day operation of the business and ensures that significant matters are brought to the attention of management and the Board as appropriate. It is through this system that the Board is able to provide oversight and direction to the Executive Directors, the Executive Team and the wider business.

Matters specifically reserved for the Board include: strategy and management; corporate structure and capital; investor relations; audit, financial reporting and controls; nominations to the Board; executive remuneration and certain material contracts.

This is available at www.halfordscompany.com/governance/matters-reserved-for-the-board

The Chairman – Key Responsibilities

- manages and provides leadership to the Board;

- builds an effective and complementary Board of Directors;

- sets the agenda, style and tone of Board discussions;

- facilitates and encourages active engagement in meetings, promoting effective relationships and open communication;

- ensures effective communication with shareholders and other stakeholders;

- acts as an advisor to the Chief Executive Officer;

- meets with the Non-Executive Directors without Executive Directors being present; and

- ensures constructive relations between Executive Directors and Non-Executive Directors.

The Halfords Board – Key Responsibilities

The Board is the principal decision-making forum for the Group, setting the strategic direction and also ensuring that the Group manages risk effectively. The Board is accountable to shareholders for the financial and operational performance of the Group. The Board ensures the workforce policies and practices are consistent with the Company’s “Behaviours”.

See examples of the Matters Reserved for the Board. A complete list of these matters is available on the Company’s website www.halfordscompany.com/governance/matters-reserved-for-the-board

Chief Executive Officer

Key Responsibilities:

- responsible for the day-to-day management of the Company;

- develops the Group’s objectives and strategy for Board approval;

- creates and recommends to the Board an annual budget and financial plan;

- delivers the annual budget and plan and executes the agreed Group strategy and other objectives;

- identifies and executes new business opportunities and potential acquisitions or disposals; and

- manages the Group’s risks in line with the Board approved risk profile.

Senior Independent Director

Key Responsibilities:

- provides a sounding board for the Chairman;

- holds meetings with the other Non-Executive Directors without the Chairman at least once a year to appraise the Chairman’s performance;

- acts as an intermediary for the other Directors; and

- is available to other Directors and Shareholders in order to address concerns that cannot be raised through the normal channels.

Non-Executive Directors

Key Responsibilities:

- evaluate and appraise the performance of Executive Directors and Senior Management against agreed targets;

- participate in the development of the Group’s strategy;

- monitor the financial information, risk management and controls processes of the Group to make sure that they are sufficiently robust;

- meet regularly with Senior Management;

- periodically visit Halfords and Performance Cycling retail stores, Autocentres outlets and Distribution Centres;

- meet together without the Executive Directors present;

- participate in a training programme including store visits and updates from management; and

- formulate Executive Director remuneration and succession planning.

Company Secretary

Key Responsibilities:

- works closely with the Chairman, Group Chief Executive Officer and Board Committee Chairs in setting the rolling calendar of agenda items for the meetings of the Board and its Committees;

- ensures accurate, timely and appropriate information flows within the Board, the Committees and between the Directors and Senior Management; and

- provides advice on Board matters, legal and regulatory issues, corporate governance, Listing Rules compliance and best practice.

Board Committees

The Board's principal Committees are the Audit Committee, the Nomination Committee and the Remuneration Committee. In addition, a Corporate Social Responsibility ("CSR") Committee was established in December 2015, comprising Directors and Senior Management and chaired by a Non-Executive Director. Each Committee has its Terms of Reference approved and regularly reviewed by the Board.

On the following pages each Committee Chair reports how the Committee they chair, discharged its responsibilities in FY19 and the material matters that were considered.

Following a Committee meeting, the relevant Committee Chair provides a report to the Board. Whilst not entitled to attend, other Directors, professional advisors and members of the Executive Team and Senior Management attend when invited to do so. The external Auditor attends Audit Committee meetings by invitation. No person is present at Nomination Committee or Remuneration Committee meetings during discussions pertinent to them. The Company Secretary acts as the secretary to the principle Committees.

Matters which require Board approval between scheduled Board meetings can be approved by a Board Committee, which consists of a minimum of two Directors. The final wording of market announcements is approved prior to release by a Disclosure Committee which is made up of a minimum of two Directors. There were four Board Committee meetings and six Disclosure Committee meetings during the period.

At executive level the day-to-day investment decisions of the Group are approved by an Investment Committee, chaired by the Chief Financial Officer. Similarly, the treasury needs of the Group are managed by the Treasury Committee, chaired by the Chief Financial Officer; the other members of these executive committees are senior members of the Finance and Treasury teams.

The Board may establish other ad hoc committees of the Board to consider specific issues from time to time. No such committees were formed during the year.

Nomination Committee

Key Objectives:

To ensure that the Board has the balanced skills, knowledge and experience to be effective in discharging its responsibilities and to have oversight of all governance matters.

Main Responsibilities

The Nomination Committee's responsibilities include:

- making appropriate recommendations to maintain the balance of skills and experience of the Board by:

- considering the size, structure and composition of the Board;

- considering Senior Management succession plans; and

- identifying and making recommendations to the Board on potential Board candidates.

Members:

David Adams

Jill Caseberry

Helen Jones

Audit Committee

Key Objectives:

To provide effective governance over the Group's financial reporting processes. This includes the internal audit function and external Auditor. The Committee maintains oversight of the Group's systems of internal controls and risk management activities.

Main Responsibilities

The Audit Committee's responsibilities include:

- making recommendations to the Board on the appointment/removal of the external Auditor, and their terms of engagement and fees;

- reviewing and monitoring the integrity of the Company's financial statements, including its annual and interim reports and preliminary results announcements and any other formal announcement relating to its financial performance, and recommending the same to the Board;

- assisting the Board in achieving its obligations under the Code in areas of risk management and internal control; and

- focusing on compliance with legal requirements, whistleblowing, accounting standards and the Listing Rules.

Members:

Jill Caeberry

Helen Jones

Remuneration Committee

Key Objectives:

To ensure that a Board policy exists for the remuneration of the Chief Executive Officer, the Chairman, Non-Executive Directors, other Executive Directors and members of the executive management.

Main Responsibilities

The Remuneration Committee's responsibilities include:

- recommending to the Board the total individual remuneration package of Executive Directors and members of the executive management;

- approving senior executive remuneration and oversight of remuneration matters generally;

- recommending the design of the Company's share incentive plans to the Board, approving any awards to Executive Directors and other executive managers under those plans and defining any performance conditions attached to those awards;

- determining the Chairman's fee, following a proposal from the Chief Executive Officer; and

- maintaining an active dialogue with institutional investors and Shareholder representatives.

Members:

Keith Williams

David Adams

Helen Jones

The Nomination, Audit and Remuneration committees' full Terms of Reference are available on the Company's website at www.halfordscompany.com/governance/committees-terms-of-reference or on request from the Company Secretary.

How the Board operates

The Board and its Committees have a scheduled forward programme of meetings. This ensures that sufficient time is allocated to each relevant discussion and activity and the Board's time is used effectively.

The table below shows the attendance of Directors at the Board and Committee meetings held during the year. In addition to those scheduled meetings, unscheduled Board and Committee meetings were convened throughout the year as and when the need arose. Meetings were convened to discuss and approve the appointments of Keith Williams as Chairman, Jill Caseberry as a Non-Executive Director, and Loraine Woodhouse as Chief Financial Officer, together with Loraine's associated remuneration package. Furthermore, three additional Board calls were held during the period to discuss the Forex hedging arrangements, Merger and Acquisition activity and to approve the appointment of the new external Auditor. These additional meetings were all quorate, and all Directors received the relevant papers and provided the required approval. During the year the Board also held three Strategy meetings to discuss the Company's strategic review.

| Board Member | Board

Scheduled: 8 | Audit

Committee

Scheduled: 3 | Remuneration Committee

Scheduled: 4 | Nomination Committee

Scheduled: 2 | CSR

Committee

Scheduled: 2 |

|---|

| Executive Directors | | | | | |

| Graham Stapleton | 8/8 | N/A | N/A | N/A | 2/2 |

| Loraine Woodhouse(Appointed: 1 Nov 18) | 4/4 | N/A | N/A | N/A | N/A |

| Jonny Mason(Resigned: 31 Jul 18) | 3/3 | N/A | N/A | N/A | N/A |

| Non-Executive Directors | | | | | |

| Keith Williams(Appointed: 24 Jul 18) | 6/6 | N/A | 3/3 | 2/2 | N/A |

| David Adams | 8/8 | 3/3 | 4/4 | 2/2 | N/A |

| Jill Caseberry(Appointed: 1 Mar 19) | 1/1 | 1/1 | 1/1 | 1/1 | N/A |

| Helen Jones | 8/8 | 3/3 | 4/4 | 2/2 | 2/2 |

| Dennis Millard(Resigned: 24 Jul 18) | 3/3 | N/A | 2/2 | 0/0 | N/A |

| Claudia Arney(Resigned: 1 Mar 19) | 7/7 | 2/2 | 3/3 | 1/1 | N/A |

Other members of the Executive Team and advisors attended Board meetings by invitation as appropriate throughout the year.

At each Board meeting, the Chief Executive Officer delivers a high level update on the business, and the Board considers specific reports, reviews business and financial performance, key initiatives, risks and governance. In addition, throughout the year the Executive Team and other colleagues deliver presentations to the Board on proposed initiatives and progress on projects.

Summary of Board Activity in FY19

| Topic | Key activities and discussions in 2018/19 | Key priorities in 2019/20 |

|---|

| Strategy | - Reviewed and approved Group Strategy, its budgetand plan; and

- Approved presentations to the City.

| - Focus on the delivery of the Capital Market Day objectives.

|

| Financial and Risk Management | - Reviewed monthly business reviews and trading performance;

- Reviewed and approved FY19 budget and forecast and FY20 outline plan and budget;

- Reviewed and approved dividend recommendations and dividend policy;

- Reviewed and approved debt decision and hedging proposal;

- Reviewed and approved prelim, interim and trading updates; and

- Considered the update on the external audit tender from the Audit Committee.

| - Ensure delivery of the FY20 budget, taking account of uncertain economic conditions;

- Simplify Board reporting; and

- Transition to the new external Auditor.

|

| Governance | - Reviewed and approved Group policies and the Group risk register;

- Reviewed and approved Directors' Conflicts of Interest register; and

- Considered updates on the Group's GDPR readiness.

| - Ensure adherence to new Corporate Governance Code developments;

- Ensure Brexit implications are understood and monitored; and

- Review the management team to ensure talent pipeline.

|

Shareholder and Stakeholder

Relations | - Reviewed prelim, interim and trading update approaches and announcements;

- Reviewed monthly investor relations reports;

- Reviewed and approved Annual General Meeting notice and form of proxy;

- Regularly reviewed draft sections of the FY18 Annual Report;

- Reviewed Shareholder body reports; and

- Discussed the Group's Corporate Social Responsibility Strategy.

| - Conduct investor perception study, and implement any recommended changes;

- Ensure relationships are built between the new management team and Shareholders; and

- Ensure the CSR team is developed.

|

| Commercial Matters | - Reviewed and approved the Bikeability partnership;

- Approved large contract renewals;

- Approved TV sponsorship with ITV;

- Reviewed Customer Service and NPS presentation and mystery shopping trial;

- Reviewed stock and customer experience updates, We Fit Service and Cycling improvement plans;

- Reviewed regular updates from Halfords Autocentres Managing Director, and the Director of Performance Cycling; and

- Received regular Brexit updates.

| - Oversee progress of plans which support improvements in retail and support plans for services development;

- Implement website development;

- Develop organisational culture to implement plans; and

- Deliver improvements in product and services consistency.

|

| Board Matters | - Reviewed the outcome of the external Board evaluation; and

- Approved the appointment of the new Non-Executive Director and Chief Financial Officer appointed during the year.

| - Ensure succession plans are in place;

- Undertake full appraisal of Board performance; and

- Ensure the Board provides the support for the new management team.

|

Board in Action

Store Visits

In July, Helen Jones, Non-Executive Director, spent the day with the Chief Executive Officer, Graham Stapleton, visiting stores and Autocentres in the Reading area. It was a good opportunity to review the new merchandising plans and marketing materials, as well as to understand from colleagues which of the promotional offers were gaining the most traction. For Autocentres the new PACE system was starting to be fully operationalised.

Helen said, "I always value time with our colleagues in store. We learn so much about what's working well and what needs our attention. It's also important to witness the Halfords experience for our customer and it's gratifying to see our expert colleagues in action. Their knowledge is all important and it's clear that our customers really appreciate the quality of our service when delivered well."

Audit Tender

It was decided at the Audit Committee that Halfords would look to tender the provision of audit services to the Group. David Adams, as Chair of the Audit Committee, met with the Head of Group Financial Reporting to set the parameters for the process, this included having a short-list of suitably qualified audit firms, and making the appointment in time for the successful firm to be in place to shadow KPMG through the FY19 year-end process.

It was imperative that the firms tendering had sufficient access to information, key people within the finance function, members of the Audit Committee, the Board and the senior management team to allow them to get a full perspective on the business.

Tender documents were issued in November 2018, following which proposals were received and reviewed. The audit firms delivered their final presentations in December 2018. The Halfords team who received the presentations included the Chair of the Audit Committee, the Chief Executive Officer and the Chief Financial Officer. In February 2019, the Board approved the recommendation that BDO be appointed, which will be formally approved by shareholders at the AGM on 31 July 2019. BDO has worked closely with the Halfords Finance team and KPMG through the FY19 year-end.

Opening of new Cycle Republic store in Bold Street, Liverpool

In November 2018, Helen Jones, Non-Executive Director, joined the Managing Director of Cycle Republic and Tredz Bikes, Peter Kimberley, at the opening of the new Cycle Republic store in Bold Street, Liverpool. A queue of customers had formed bright and early along with the local press, eagerly awaiting the start of the official proceedings.

Following the 'ribbon cutting', the doors opened to reveal an impressively presented store. Colleagues immediately engaged with customers and Helen and Peter took the opportunity to review the layout and ranges on display. They chatted with the store manager, area manager and technicians.

Concerns

The Chairman seeks to resolve any concerns raised by the Board, whether these arise in a Board meeting or in another forum. Where raised and unresolved in a Board meeting, the unresolved business can be recorded on behalf of a Director in the minutes of the relevant meeting. A resigning Non-Executive Director would also be able to raise any concerns in a written letter to the Chairman, who would bring such concerns to the attention of the Board. No such concerns have been raised throughout the period.

Skills and Experience of the Board

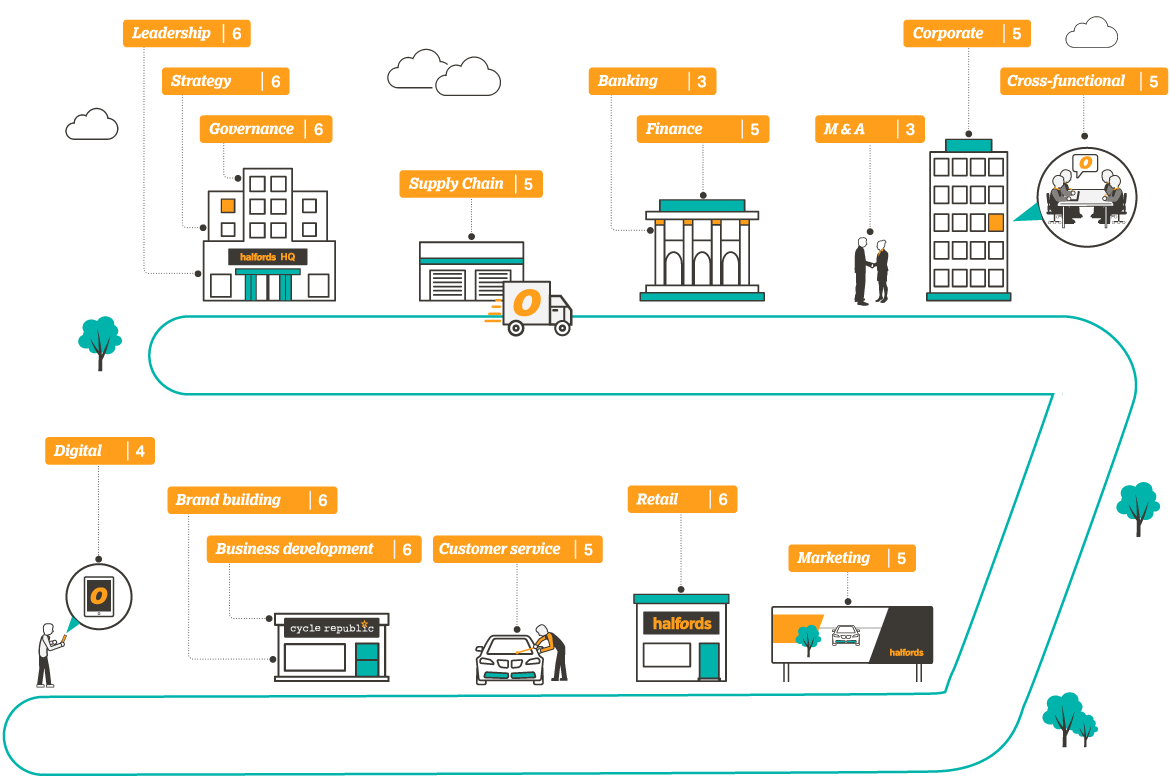

Delivering the journey

The below graphic illustrates the number of Directors on the Board who have the relevant skills and experience.

Diversity

The Group recognises the importance of diversity, including gender diversity, at all levels of the organisation. The Group's Diversity Policy (the "Policy") is reviewed annually and sets out our commitment to eliminating unlawful discrimination and promoting equality of opportunity. The Policy is applied to the Group including the Board and it is considered that the background and experience brought to the Board by each individual Director exemplifies and personifies the Board's commitment to its Diversity Policy.

The Group does not apply a fixed quota on diversity to decisions regarding recruitment. The Nomination Committee considers the Policy and ensures we have a sufficiently diverse Board in terms of age, gender and educational and professional background. The Nomination Committee also keeps under review the structure, size and composition of the Board. Additionally, it considers the capability and capacity to commit the necessary time to the role in its recommendations to the Board. The intention is to ensure the appointment of the most suitably qualified candidate to complement and balance the current skills, knowledge, experience and diversity on the Board. Those appointed are deemed to be the best able to help lead the Company in its long-term strategy. At Halfords half of the Board is female, which exceeds the recommended target as published by the Hampton-Alexander Review ("Improving Gender Balance in FTSE Leadership") in November 2017. The charts demonstrate the gender split at Board level, within Senior Management and across the workforce as a whole.

The Board is well placed by the mixture of skills, experience and knowledge of its Directors to act in the best interests of the Company and its shareholders.

Key Facts