An exciting time for Halfords

We have a clear plan aimed at driving sustainable long-term growth.

Our new strategy will ensure that we remain focused on our core motoring and cycling offers, enabling customers to buy products and services with features and benefits that they not only desire but are only available at Halfords.

Halfords Group has delivered sales and Free Cash Flow growth in what remains a challenging UK consumer environment. While motoring continued to be impacted by extremely mild weather conditions, we are pleased to have seen continued and sustained growth in cycling, underpinned by improvement in our exclusive own brand ranges.

Graham Stapleton

Chief Executive Officer

Financial

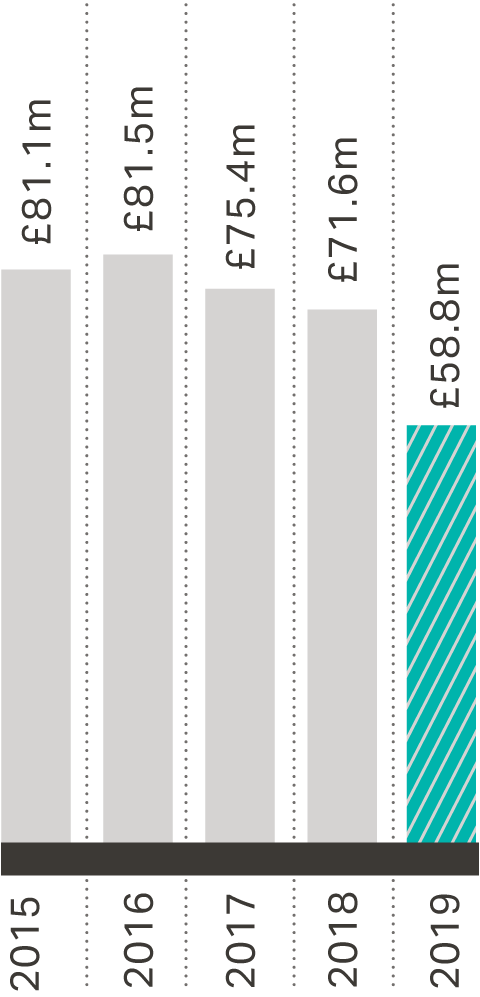

Underlying Profit Before Tax

-17.9%

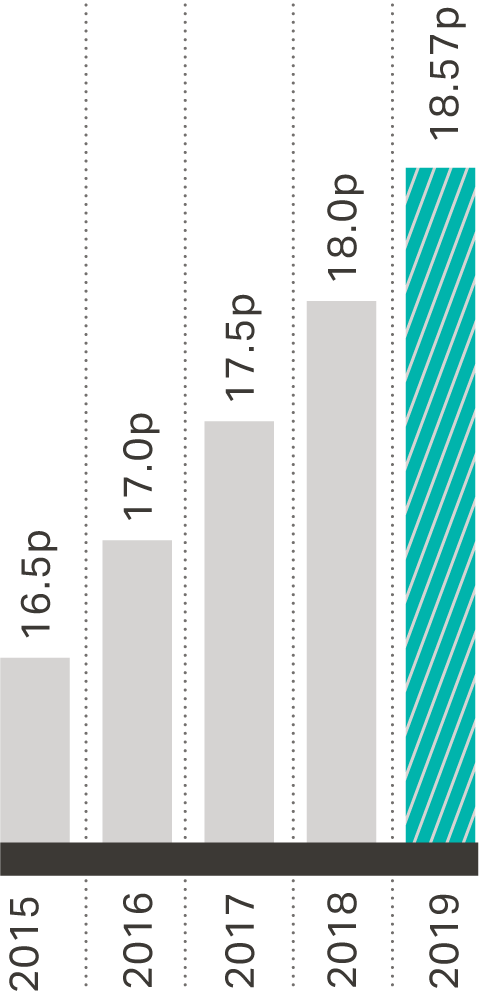

Dividend Per Ordinary Share

+3.0%

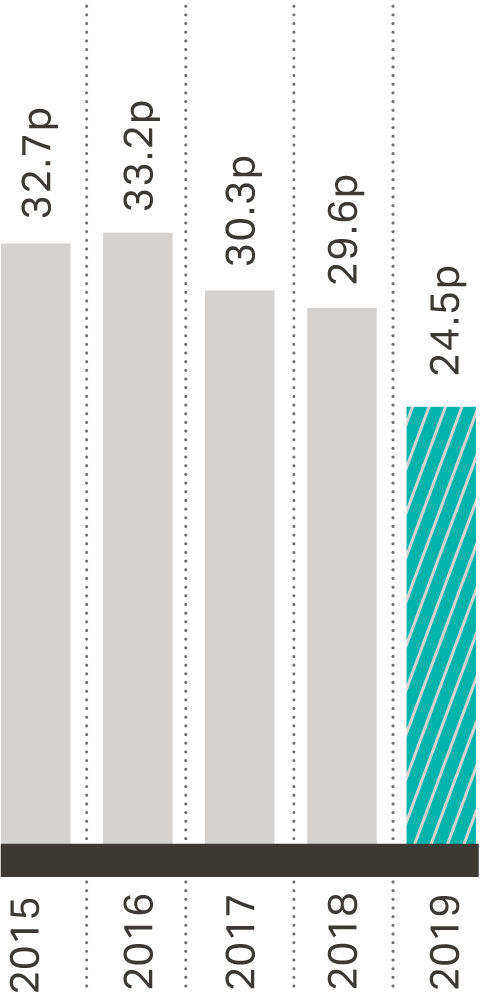

Underlying Basic Earnings Per Share

-17.2%

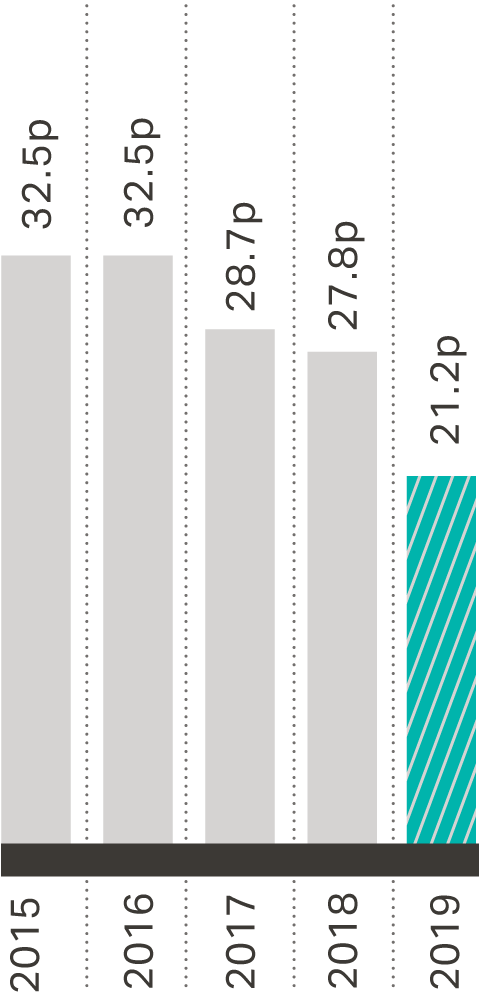

Basic Earnings Per Share

-23.7%

Operational

75%

Group revenue matched to customers

24%

Total Group sales which are service-related

83%

of halfords.com online orders click and collected in-store

80

In-store Retail services across motoring and cycling

0.8:1

Net debt to Underlying EBITDA ratio

20%

Group revenue from online sales

Our Annual Report and Accounts includes Alternative Performance Measures (APMs) which we believe provide readers with important additional information on the Group. A glossary of terms and reconciliation to IFRS amounts is included here.